Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

Comments: stock index fell 0.9% CPI data suppress bull mood

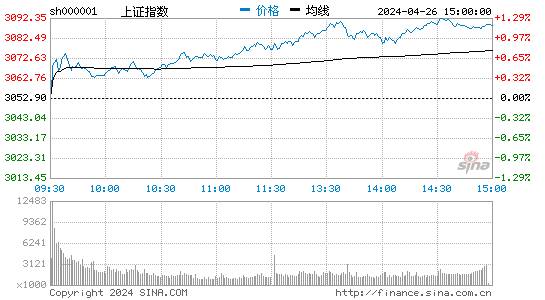

Today, the two cities opened slightly earlier.

Disk market conditions

Today, highway bridges and plates are on the contrary, Longjiang traffic [2.90 9.85% shares bar Research Report] limit, Jilin high speed [2.85 9.62% shares bar Research Report] up more than 9%, Zhongyuan Expressway [2.66 2.70% shares bar Research Report, Sichuan Chengyu [3.74 1.36% 1.36% bar Research Report, Shandong high-speed [3.67 0.82% 0.82% bar Research Report], Wan Tong high-speed 1.56% 1.56% shares, research report] all rose more than 2%, the whole plate is red across the whole line.

On the news side,

Shanghai and Shenzhen two cities

13 of the 19 A - share freeway listed companies have announced the 2011 Annual Report, with an average gross margin of 56.08%, while the highest [10.29 -0.68% share in Chongqing, Luqiao, has reached a gross margin of 91.14%.

The level of gross profit is even higher than that of the liquor industry.

Data show that the gross profit margin of Guizhou Moutai [209.26 0.62% shares Research Report]2010 is 90.95%.

Today, the rare-earth permanent magnet plate has risen all over the world, leading the leading colored [65.37 2.20% shares, research report] has risen by more than 5%, the [22.94 0.04% shares of the Chinese stock company, the research report], Tibet's development of [21.03 -1.36% shares, the research report], the North Mine magnetic material [15.09 -1.11% share bar Research Report, the development of [26.07 -0.69% shares of the five mines, and the Hengdian East magnetic [17.05 -2.52% Stock Research Report] all rose more than 1%.

In the United States, Europe and Japan, China's rare earth [2.28 2.24%] export litigation is pending, the rare earth industry is quietly ushered in many benefits.

It is reported that China's rare earth industry association, which had been brewing for four or five years, was officially launched in April 8th.

The data show that the price of rare earth stabilized in the middle of last month, and the prices of most varieties appeared again last week.

In the early days, the rapid growth of the cement sector, Sichuan double horse [8.61 5.39% shares bar Research Report] rose more than 8%, Tongli cement [11.19 1.63% shares, research report], tower group [9.48 0.85% shares bar Research Report, Huaxin Cement [14.43 2.41% stocks, research report] all rose more than 3%.

On the news side, in April 8th, at the seminar on "China cement related industries development and cement marketing mode innovation seminar" held by China Cement Association, sources said that the revision of nitrous oxide emission standards for cement enterprises has been officially established, and the new standard will not be more stringent than the most stringent 500 mg / standard cubic meter of international existing, and the cement enterprises involved in emission reduction will receive financial subsidies.

On the news side, the recent two products of golden dragon fish oil and peanut oil have been priced at about 8% by the end of March.

The rise in the price of edible oil has played a positive role in grain and oil companies whose gross profit margins are very low.

Two level market, Dongling cereals and oils [15.41 0% shares bar Research Report] and West Wang food [27.61 5.58% shares bar Research Report] the morning market rose more than 5%.

Securities dealers said that the price adjustment, from production enterprises to distribution channels, wholesalers and terminal stores price adjustment completed a certain period of time, is expected to be around three to four weeks.

At the same time, soybean and soybean meal prices have risen sharply in recent years, and related stocks will continue to rise.

Policy aspect

The CBRC requires banks to strictly charge directory fees from April, and no regulations will be imposed on the fees charged by banks. The State Council will formulate regulations to eliminate the room for profit making; the Ministry of Industry issued the software and information technology services development plan in 12th Five-Year; the development and Reform Commission will deploy eight economic operations; the five cities in Beijing, Tianjin, Shenzhen, Nanjing and Guangzhou will be upgraded to pilot projects; the pricing scheme for electricity pricing will be introduced in all parts of the country; it is expected to be launched in the two quarter; the Ministry of land said that it will vigorously cultivate new marine industries in 12th Five-Year; the National Association of rare earth industries will be established; the Business Innovation Conference of brokers will be convened soon; Shanghai and three places will carry out the pilot project of methanol vehicle industry.

Message plane

March economic data released today, the market is expected to CPI or up to 3.5%; the Guangdong pensions manager has decided that the investment plan is mainly stock; the central bank has been suspended for 13 weeks; the new third board will be launched in the three quarter, and the two cities will sell shares this week.

Lifting market value

Up to 26 billion 200 million yuan; national life, Ping An and Xinhua three insurers plan to refinance 87 billion yuan; the A share allotment plan of the China Merchants Bank has been approved, and the A+H stock raising fund is 35 billion yuan; the Shanghai bank intends to raise A+H 36 billion yuan.

- Related reading

- Professional market | How Do We Bypass The Infringing Pit Of The Brand?

- Market trend | Italian Company Will Become The New Owner Of Shanghai

- Market trend | Taobao Tmall Issued The Industry Standard. The Unqualified Products Without Qualification Will Be Put Off The Shelf.

- market research | Why Has The Southeast Asian Electricity Supplier Market Become A Bobo?

- Market prospect | Retail Sales Are Showing Signs Of Improvement. Why Is The Department Store Closing Tide Continuing?

- Dress culture | What Do You Think Of The Chinese Award Dress Designed By Anta In Winter Olympics?

- Enterprise information | The United States Will Gradually Shift To The Emerging Retail Channels Of Various Shopping Centers In The Future.

- Children's wear | Children'S Clothing Market Lacks Professional Talents. What Are You Waiting For?

- Standard quality | XTEP Men'S Shoes Were Unqualified By Shanghai Quality Supervision Bureau

- Gym shoes | "Black Dragon" Ice Skates Return To Bankruptcy In The Middle And High-End Market.

- Comparison Between Sports Brand Lining And Nike

- Listed Companies Are Now Laying Off Workers: Home Appliances, Textiles And Other Industries Become The Worst Hit Areas.

- 郭巍青:中等收入是一个馅饼 还是一个陷阱

- Zhu Hai: Why Is China'S Happiness Index Lower Than Russia And India?

- Sandals Appeared In The First Half Of The Month In &Nbsp; The Average Price Was 20% Higher Than Last Year.

- 欧系货币全线下挫 美元获益走强

- Global Financial Markets A Big Theme On Friday

- 运动品牌代言初探草根营销战略

- 中国银行业或面临信贷风险

- 中银绒业利润激增202.66%