Anxious Moment Of US Dollar Fund: IPO And Project Transfer Are Difficult, Helping The Invested Companies To Comply With The Regulations And Transform

"Now, regardless of the level of returns, it's very satisfying that the project can exit." Wang Qiang (pseudonym), a person in charge of US dollar PE fund, said with emotion to the reporter of 21st century economic report.

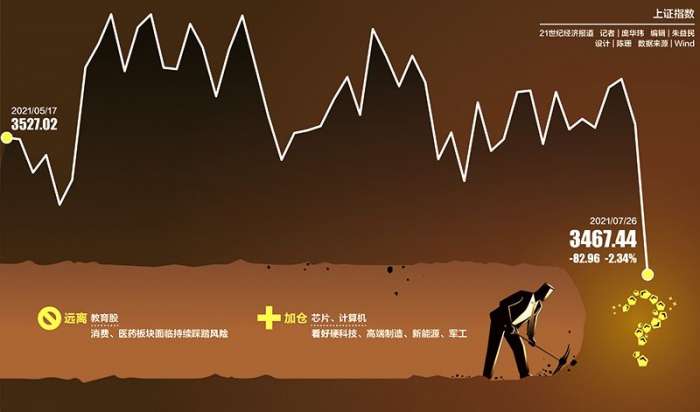

In mid July, the relevant departments issued the "Internet Security Review Measures (Draft for comments on the revised draft)", and the relevant departments strengthened the strict supervision of education and training, Internet anti-monopoly and other fields. In addition, the supervision boots of e-cigarettes and games have not yet been implemented, the US dollar PE fund managed by him has suddenly encountered a "shortage" of project exit - two projects have been suspended from listing in the United States, Three projects were postponed to the United States.

"It also puts a lot of pressure on us to be accountable." He said it bluntly. In the past half a month, several LP (funders) of the rich family office have called to ask whether these projects can be IPO before the expiration of PE fund, and if the project can not exit before the expiration of the fund, whether the fund manager (GP) has the ability to operate the project transfer.

Wang Qiang disclosed that at present, his US dollar fund is looking for s fund or large LP institutions to seek project transfer opportunities. However, due to policy supervision, there is great uncertainty in the future IPO prospects and high growth of performance of these projects. Many potential bidders have quoted extremely low valuations (far lower than the previous round of equity financing valuation of investment projects), They are in a dilemma.

The 21st century economic reporter has learned from many sources that there are quite a few US dollar PE funds that have encountered similar difficulties.

"Now, investment banks do not support projects to go public in the United States with a strong head." A founding partner of a large US dollar PE fund told 21st century economic reporter. As the US Securities Regulatory Commission (SEC) requires Chinese enterprises going to the United States in the future to strengthen the business structure between the vie structure and domestic business entities, as well as the information disclosure of the risk impact of China's policy supervision, if Chinese enterprises do not fully disclose information in this respect and encounter huge claims from American investors, it will be "more than the gain".

"At present, we can only expect investment projects to regain new growth momentum and IPO operation space through business transformation and compliance operation." He said it bluntly. At present, a domestic education and training institution invested by him has clearly indicated the transformation to quality education and adult vocational training education. However, for the new round of equity financing (helping business transformation) proposed by the education and training institution, they decided to suspend investment.

"It is not that our GP management team does not support its business transformation, but that the Fund LP is quite pessimistic about the future development prospects of the education and training track, which makes GP not sure to persuade LP to continue to support the transformation and development of education and training projects." He explained.

Tight listing in the United States and the difficulty of project transfer

After the promulgation of the "Internet Security Review Measures (Draft for comments on the revised draft)" and the strengthening of strict supervision by relevant departments in the fields of games, e-cigarettes, education and training, and Internet antitrust, a number of Chinese enterprises planning to go to the United States for listing have terminated the IPO process. Among them, xiaohongshu, halo travel, qiniuyun and keep withdrew their IPO plans in the United States, while Himalaya and torala canceled their IPO plans in the United States.

"A lot of dollar PE funds feel hurt." Wang Qiang said frankly. Originally, they planned to incorporate two of these projects into successful investment cases as "important attraction" for the new US dollar PE Fund. Now, they have to revise the PE fund-raising materials of the new US dollar, increase the research and judgment on the trend of strict supervision of relevant industries, and how to adjust investment strategies to avoid investment stepping on thunder.

However, a number of Fund LP (Investor) on the project to suspend the listing in the United States "do not grudge.". In the past half a month, several family office LP's have called one after another to inquire whether the investment project can exit the IPO before the expiration of the fund under the pressure of policy supervision, and if it fails to exit on time, whether the GP management team can promote the project transfer.

"We don't know about it." Wang Qiang told the 21st century economic reporter. Since late July, they have communicated with a number of companies planning to go to the United States for listing. They have found that Internet companies currently involved in 2C end (for mass consumers) have indicated that they need to wait for a long time. Until the policy is clear and the regulatory rules of China capital stock listing issued by China and the United States, the IPO process can be restarted; The 2B end (enterprise oriented) enterprises said that the investment banks did not recommend them to go to the United States to go public, because the risk warning of the SEC has made Wall Street hedge funds reduce the valuation of China capital stocks, leading to enterprises listing in the United States may not be able to obtain the ideal amount of financing and valuation.

He said that at present, US dollar PE funds are also well prepared for the worst. If the project fails to IPO before the expiration of the fund, they will quickly look for fund s or large LP institutions to seek project exit. However, due to the high uncertainty of the future high growth prospects of Internet, education and training industries caused by policy regulation, s fund has significantly lowered the project transfer valuation, leading them to "abandon" or "not throw", They are facing big losses.

"This has led us to readjust our future investment strategies, such as substantially reducing the amount of equity investment in 2C end Internet, education and training, and suspected market monopoly of regulatory industry track, increasing whether the invested industry meets the needs of China's economic and social development in the future, and whether it has long-term policy support." Wang Qiang said.

In his view, policy regulation is not necessarily a bad thing. In the past, many PE funds were scrambling for the leading enterprises at high prices, which led to the expansion of the valuation bubble of hot industry track. Now, under the increasingly strict policy supervision, equity investment is rapidly returning to "rationality" -- more and more PE funds realize that it is increasingly "impossible" for PE funds to compete for the leading enterprises of track by high prices, and need to improve their professional investment and industry supervision, research and judgment ability.

Multi pronged "rescue" expected return

While seeking project transfer, many US dollar PE funds are also paying close attention to the business transformation effect of track enterprises such as education and training, games and so on. By strengthening post investment management services, the expected return on equity investment can be achieved.

At the end of July, ape counseling launched a new brand "pumpkin science", which focuses on steam science education, and announced the transformation of quality education.

According to the head of ape guidance, this is the first transformation of ape counseling. Besides pumpkin science, ape counseling is also exploring a series of quality education products including ape programming and zebra.

Prior to that, due to the impact of the epidemic, the online education track was hot. Ape counseling realized equity financing of more than 3.5 billion US dollars in 2020, and the enterprise valuation once reached about 17 billion US dollars.

"At present, many PE funds participating in ape's equity investment are looking forward to its rapid transformation, complete business transformation, and then restart the IPO process. Otherwise, the huge equity investment funds may be completely wiped out." The founding partners of the above-mentioned large-scale US dollar PE fund told the reporter of the 21st century economic report.

In his view, whether it is involved in quality education or the layout of adult vocational training education, the business transformation of education and training institutions will not be smooth sailing. However, many venture capital institutions are still optimistic about the huge customer base and business transformation execution of these institutions, which can eventually bring good performance results.

The 21st century economic reporter has learned from many sources that in order to help the business transformation of track enterprises such as games, education and training to be effective as soon as possible, some US dollar PE funds are actively recruiting talents who are proficient in policy supervision, compliance operation and resource integration, and expand the post investment management team to help the enterprise transformation journey faster and more stable.

In addition, many US dollar PE funds are closely evaluating the business compliance operation progress of 2C end Internet platform. At present, in order to be listed in the United States as soon as possible, some 2C end Internet platforms intend to divest the 2C end business and restart the IPO process as a technical service provider, so as to meet the requirements of the "network security review measures (Draft Revision)" and the strict supervision of relevant industries.

"But we don't want to see this project spin off the business for a US listing at the expense of valuation." The former founding partner of US dollar PE fund told 21st century economic reporter. If these 2C end Internet platforms strive to be listed in the United States as soon as possible, just to meet the terms of the IPO gambling agreement, they are actively contacting other equity investment institutions, persuading the latter to jointly postpone the time point of the IPO gambling agreement, give investment enterprises more time to wait for regulatory policies to be clear and the compliance operation requirements are implemented, and strive to be listed with overvalued value.

At the same time, he is also "ready with both hands" -- at present, they are communicating with many domestic securities companies and recommending the 2C end Internet platform invested in to be listed on the domestic science and technology innovation board and the gem.

"At present, the projects invested by the US dollar fund are listed in China and exit, and the operation of the corresponding foreign exchange exchange exchange of the investment principal and profit is relatively smooth. Therefore, many US dollar fund LP also approve the domestic listing of the project, which makes our project exit path increasingly diversified, and has the ability to cope with the impact of stricter regulatory policies on listing in the United States." He said it bluntly.

- Related reading

Is Ma Yun Completely Invisible? Ali'S Financial Report In The First Quarter Of Fiscal Year 2022 Transmits Three Signals

|

A Shares In Two Days "Evaporation" Of 4 Trillion Market Value Of Foreign Capital Fleeing Private Placement Passive Reduction

|- Dress culture | Chinese Valentine'S Day On Chinese Valentine'S Day

- Celebrity endorsement | Koradiar'S Double Spokesmen: Tong Liya And Miranda Kerr, A Combination Of Chinese And Western Culture, Presenting New Elegance

- Zhejiang | Jiaxing Xiuzhou High Tech Zone Held Garment Industry Skills Competition

- Local hotspot | Nanning Customs Helps Small Cocoons To Eliminate Gold Thread

- Fashion blog | Enjoy The Release Of "A Positive Message" Series In Autumn And Winter

- neust fashion | Kapok Road | National Style Beauty Haunts CBD, To Feel This Wave Of Beauty Attack!

- Shoe Express | Adidas Revenue In China Fell 16% In The Second Quarter

- Industry stock market | Jiahua Energy (600273): The Net Profit In The First Half Of The Year Increased By 28.47% Year On Year, And It Is Planned To Pay 2.5 Yuan For 10 Shares

- Industry stock market | Huafang (600448): Transfer Of State-Owned Equity

- Daily headlines | Economic Operation Of China'S Garment Industry From January To June 2021

- From The Supply Side To Suppress The "Pig Cycle" Six Departments To Create A "Safety Chain" Of Pork Supply

- SMIC'S Net Profit Increased 4 Times In The Second Quarter, And The Production Capacity Was Tight Until The First Half Of 2022

- In The First Half Of 2021, The Recovery Of Luxury Goods "Accelerates" Industry Differentiation, Leading To M & A Wave

- 河南零担新锐危局背后:快运市场的“长尾”之痛

- Behind The Sharp Crisis Of Less Than Carload In Henan: The Pain Of "Long Tail" In Express Market

- Chinese Valentine'S Day On Chinese Valentine'S Day

- Koradiar'S Double Spokesmen: Tong Liya And Miranda Kerr, A Combination Of Chinese And Western Culture, Presenting New Elegance

- Jiaxing Xiuzhou High Tech Zone Held Garment Industry Skills Competition

- Nanning Customs Helps Small Cocoons To Eliminate Gold Thread

- Enjoy The Release Of "A Positive Message" Series In Autumn And Winter