Analysis On The Operation Of Home Textile Industry In The First Quarter Of 2019

In the first quarter of 2019, the overall performance of the home textile industry tended to be stable under the complicated international economic situation and many complicated factors such as the Spring Festival holiday. Industry exports steadily increased, industry efficiency decreased compared with last year, but efficiency has been improved. The industry expects more optimism in the two quarter.

First, stable development of the industry as a whole.

According to the statistics of the National Bureau of statistics, in the first quarter of 2019, the main business income of 1791 domestic textile enterprises reached 51 billion 139 million yuan, an increase of 8.73% over the same period last year.

The 219 key enterprises tracked by the association realized the main business income of 17 billion 852 million yuan in the first quarter, down 1.34% from the same period last year.

The 16 home textile industrial clusters tracked in the first quarter achieved 55 billion 56 million yuan in main business income, up 2.72% over the same period last year.

The industry's domestic output value shows the same trend.

(see table 1.)

Table 1.2019 main indicators and year-on-year growth of the textile industry in the first quarter of the year (unit: 100 million)

Source: National Bureau of statistics, China Textile Association

From the home textile sub sectors, the main business income of the bedding industry in the first quarter has been relatively lower. The 4 bedding industry clusters tracked by the association achieved 23 billion 69 million yuan in the first quarter, down 3.56% compared to the same period last year, and the main business income of 107 bedding enterprises decreased by 1.80% compared to the same period last year.

Towels and fabric industry remained stable and better overall growth.

The income of home textile sub sectors under various statistics is shown in figure 1- 3.

Source: China Home Textile Association

Two, industry export stability slightly increased

According to customs data, the total import and export volume of the textile industry in the first quarter of 2019 amounted to 9 billion 299 million US dollars, of which the export volume was US $8 billion 961 million, an increase of 0.55% over the same period last year. The import volume reached US $339 million, a decrease of 1.42% over the same period last year, and the realization of the trade surplus of US $8 billion 622 million.

Industry exports remained stable overall.

From the perspective of the export products category, the export of bedding products increased steadily. In the first quarter of 2019, the export of bedding products totaled 2 billion 785 million US dollars, accounting for 31.08% of the total export volume of domestic textiles, and the export volume increased by 2.69% over the same period last year.

The growth of food textiles is relatively large.

In the first quarter, the export of food and beverage textiles amounted to US $547 million, an increase of 6.12% over the previous year, accounting for 6.10% of the total export volume of home textiles.

Exports of cloth, towels and blankets decreased compared with the previous year.

The export situation of all kinds of home textile products is shown in Table 2.

Table 2.2019 exports of major textile products in the first quarter of 2009

Source: China Customs

From the perspective of the main market of export products, the export volume of several important markets in China in the first quarter of 2019 has increased fairly well.

The three major traditional markets in the United States, Europe and Japan are still in the leading position, and the share share is further expanded.

In the first quarter, the total export volume of China's textile products to the US, EU and Japan markets amounted to 4 billion 669 million US dollars, accounting for 52.13% of the total exports of the industry, and the share share continued to expand by 0.76 percentage points over the same period last year.

The ASEAN market grew well in the first quarter, with an increase of 7.48%, achieving an export volume of US $999 million, accounting for 11.15% of the total export volume of the industry, an increase of 0.72 percentage points over the previous year.

Vietnam is China's most important export country for ASEAN textile products. In the first quarter, it exported a total of US $290 million to Vietnam's home textile products, of which $139 million was exported in March.

Table 3.2019 main export market volume and year-on-year

Source: China Customs

Due to the impact of Sino US trade friction, the export of tax related carpet products to the US market in the first quarter decreased by 27.32% compared with the same period last year, and the export volume was $100 million, the largest decline in the same export products.

At the same time, carpet exports to the EU, Japan and ASEAN markets have increased fairly well.

(see chart 4.)

Source: China Customs

Three, industry efficiency decline, efficiency improvement

In the global trade downturn, the domestic and international macroeconomic situation is complex and the Spring Festival factors and other factors, the domestic textile industry in the first quarter production growth slowed down, the profit declined year by year.

The market closed early or postponed.

Let profits sell, enterprises go to stock more actively, and turnover rate of finished products is higher than that of last year.

According to statistics from the National Bureau of statistics, the profits of 1791 home textile enterprises above Designated Size reached 2 billion 30 million yuan in the first quarter, down 7.41% from the same period last year, and the decline was narrowed compared with the previous two months.

The profit margin was 3.97%, down 0.69 percentage points from the same period last year.

The 219 backbone enterprises and 16 industrial clusters tracked by the association also showed this characteristic basically.

(see table 4.)

Table 4.2019 profit growth of home textile industry in the first quarter

Source: National Bureau of statistics, China Textile Association

Home textile production and sales index declined.

In the first quarter of 2019, production arrangements for home textile enterprises were slowed down by factors such as Spring Festival holidays and weak domestic and foreign market demand.

According to the survey of textile and garment enterprises' management and management, the first order index of home textiles in the first quarter was 47.75, lower than that in 2018.

Among them, the foreign orders index was 53.6, an increase of 1.95 points over the fourth quarter of 2018.

The production index was 51.1, down 8.35 points from the same period last year, but 2.5 points higher than in the fourth quarter of 2018.

The inventory of finished products in industrial enterprises has declined, and the efficiency of the industry has been improved.

According to the survey results of textile and garment enterprises management questionnaire, the inventory index of finished goods in China's textile industry in the first quarter of 2019 was 38.6, a drop of 19.95 points over the four quarter of 2018.

It can be seen that in the first quarter, home textile production enterprises are more active in inventory, slower in stock preparation, and faster in production inventory.

According to the data of the National Bureau of statistics, the turnover rate of finished products in the textile industry was 16.52 in the first quarter, up 0.28 points from the same period last year.

Industry capacity utilization increased.

According to the survey results of textile and garment enterprises' management and management, the utilization rate of 60.5% of the home textile sample enterprises in the first quarter of this year was over 80%, which was higher than that of the previous period and the same period last year.

The home textile sample enterprises with less than 50% of the equipment utilization capacity decreased compared with the previous year.

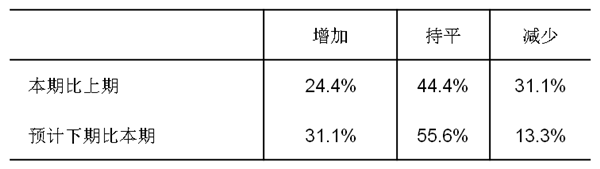

Four, enterprises are optimistic about the two quarter of the industry.

According to the survey results of textile and apparel enterprises' management questionnaire, 34.1% of the sample enterprises of the home textile sample enterprises choose to increase the demand for orders in the two quarter of 2019. 50% of the enterprises choose to be "flat" and the enterprises' anticipation is more cautious.

For the two quarter of the company's main product production, home textile enterprises are optimistic about future production.

The proportion of home textile enterprises expected to grow is 38.6%, which is 5.3 percentage points higher than that of the main products in this period.

For the two quarter of 2019, the proportion of home textile enterprises expected to increase profits is 31.1%, which is 6.7 percentage points higher than that of the home textile enterprises with increased real profits.

It shows that the sample companies are optimistic about the two quarter earnings (see Table 5).

Table 5. profit situation of home textile enterprises (%)

Source: China Home Textile Association

(Note: This is the first quarter of 2019, the next is the two quarter.

The same below)

The company has a positive attitude towards the next batch of raw materials.

For the next estimate of raw material purchase, 25% of home textile sample enterprises chose "increase", which is higher than the expected increase of the sample enterprises in this period (see Table 6).

Table 6. main raw material purchase quantity of home textile enterprises (%)

Source: China Home Textile Association

According to the expectation of the overall operation of the textile industry in the two quarter, the proportion of "optimistic" home textile enterprises is 37.8%, which is 2.5 percentage points higher than the related options of the textile industry; the proportion of selecting "general" home textile enterprises is 55.6%, which is 4.4 percentage points higher than that of the textile industry related enterprises, showing that home textile enterprises are more optimistic about the overall macroeconomic operation of the next stage (see Table 7).

Table 7. views of home textile enterprises on the overall operation of textile industry (%)

Source: China Home Textile Association

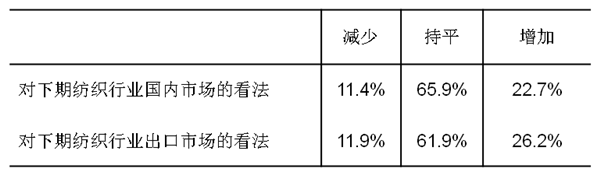

For the next stage of domestic and foreign market judgement, sample enterprises are more optimistic about the expected increase of the two markets.

The demand for textile and apparel market in the domestic market is expected to be 88.6% higher than that of the home textile samples in the current period. The expected demand for foreign textile and garment market in the next period will be 88.1% higher than that in the current period (see Table 8).

Table 8. expectations for the next textile and garment export market (%)

Source: China Home Textile Association

On the whole, the overall market demand in the first quarter of 2019 was not strong, and the order quantity of home textile enterprises declined compared with the previous period.

With the gradual improvement of the domestic market environment, the relevant policies to play the policy effect, there will be room for recovery in the two quarter, and enterprises' confidence in the two quarter will be enhanced.

- Related reading

April Monthly Report: Domestic And Foreign Cotton Futures Weaken Sharply, Cotton Yarn Prices Are Weak.

|- Information Release of Exhibition | 2012 (Shanghai) Eleventh Venture Capital Investment And Franchise Exhibition

- DIY life | How To Properly Wear And Maintain Jewelry?

- Footwear industry dynamics | Exchange Rate Continues To Appreciate &Nbsp; Shoe Enterprises Profit Margins Are Getting Thinner.

- Local hotspot | The Helpless Of Wenzhou Enterprises' People'S Loans Is Not To Die Immediately, But To Die Slowly. "

- Enterprise information | Bright Eyes To Children'S Wear BABIBOO Will Show Its Charm In Pazhou Museum, Guangzhou.

- Shoe Express | 彪马明年大举进军印度市场 计划增加100多家新店面

- quotations analysis | 山东:棉花行情弱势 籽棉收购量较小

- quotations analysis | 常熟(市区琴湖路及古里镇)涤丝市场一周行情点评

- quotations analysis | 盛泽化纤市场行情动态快报

- Instant news | 外贸环境忐忑变数 中国鞋企生存艰难

- The Subsidiary'S Performance Compensation Scheme Has Not Reached An Agreement With Shenzhen Textile A: Negotiations Are Under Way.

- Plunge 11%! Who Is Controlling The Price Of Zheng Cotton? The Result Is Not Simple.

- Topshop, The Former King Of High Street, Will Announce The Bankruptcy Reorganization Plan

- CK "Wake Up Like A Dream" To Find New Creative Direction

- Wei Underwear Is In A Precarious Position And The US Market Share Is Only 24%.

- What Is The Expressive Force Of TOP100, Anta And Lining?

- LVMH'S Co - Brand With Rihanna Will Push The First Flash Store In Paris

- The Local Garment Retail Industry Is Stable, And The High-End Consumer Market Is Warming Up.

- Longchamp'S Logo Letter Pack Became The Latest Internet Red It Bag.

- 173 Companies Such As Nike And Adidas Wrote To Trump: Adding Tariffs Is A Disaster.